Industry reports point to a U.S. cashew market that continues to expand — though estimates on its current size vary widely depending on how analysts define it.

Market Signals: Steady Growth, Unclear Baseline

Recent market studies differ sharply on the value of the U.S. cashew sector:

- Grand View Research estimates the U.S. cashew kernel market at USD 1.7 billion in 2023, projecting a 4.7 % CAGR through 2030.

- Future Market Insights (FMI) values the processed cashew segment at USD 693 million in 2025, growing 6.9 % annually to 2035.

- Mordor Intelligence positions the market between those, at USD 1.32 billion (2025) rising to USD 1.69 billion by 2030 (+5.1 % CAGR).

Despite the different baselines, all sources agree on one thing: U.S. demand is growing at a healthy mid-single-digit rate, driven by changing diets and a stronger focus on plant-based, protein-rich foods.

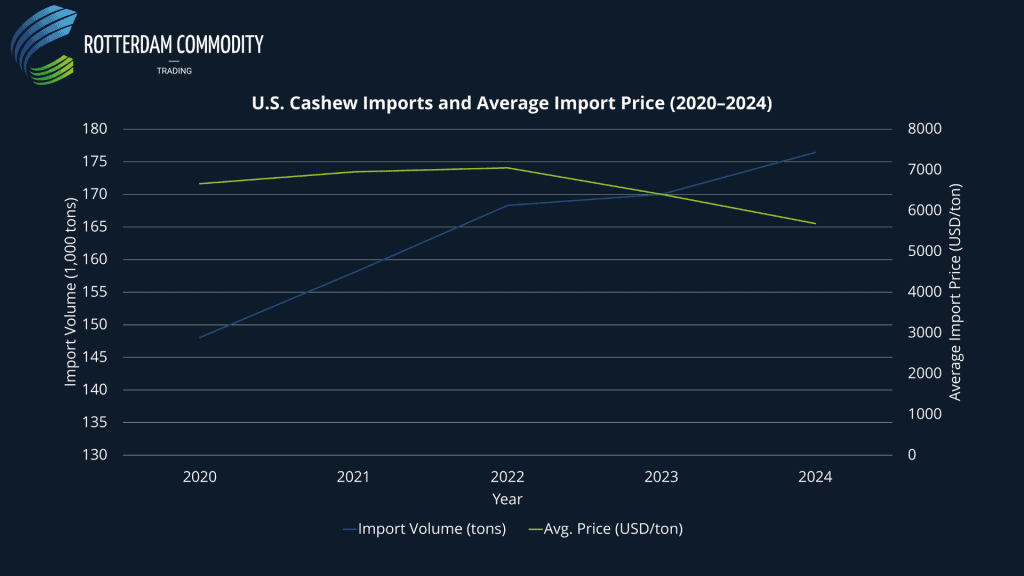

Trade Data Confirms Rising U.S. Demand

According to ITC Trade Map and UN Comtrade, U.S. cashew imports have steadily increased over the past four years:

| Year | Import Volume (tons) | Import Value (USD million) | Avg. Import Price (USD/ton) |

|---|---|---|---|

| 2020 | 148,050 | 987 | 6,660 |

| 2022 | 168,320 | 1,187 | 7,050 |

| 2024 | 176,426 | 1,100 | 5,685 |

That represents a 19 % rise in import volumes (2020–2024), showing that U.S. consumption expanded as softer kernel prices encouraged restocking and boosted retail sales.

Average import prices fell roughly 12 % YoY in 2024, easing pressure on roasters and processors after two years of elevated costs.

Demand Drivers: Health, Convenience & Product Diversification

Cashews have become a core part of the “better-for-you” snack movement in the U.S.

- Processed cashews — roasted, seasoned, or blended — dominate retail channels.

- Cashew-based dairy alternatives (milk, yogurt, cheese) continue to outpace most other plant-based categories.

- Market data shows that cashews now reach roughly one-third of U.S. households, a penetration rate rarely achieved by tree nuts.

The broader health and wellness shift remains the key structural driver through 2030.

Supply Chain: Vietnam Dominant, Africa Competitive

The U.S. cashew supply chain remains heavily concentrated in Vietnam, which supplied about 75% of all U.S. imports in 2024.

However, sourcing diversification is gaining traction:

- Trade policy changes in 2025 have introduced new uncertainty. A 46% tariff imposed in April on Vietnamese cashew kernels has now been revised and confirmed at 20%, easing some pressure on import costs but still prompting risk reassessment among buyers.

- West African processors, led by Côte d’Ivoire, are expanding direct exports to the U.S.

- African processing output rose 12–15% YoY in 2024, according to trade data and regional industry sources.

| Country | Tariff Rate on Cashew Kernels (2025) |

|---|---|

| Vietnam | 20 % |

| Côte d’Ivoire | 15 % |

| Benin | 10 % |

| Ghana | 15 % |

| Nigeria | 15 % |

| Tanzania | 10 % |

For buyers, this shift introduces both opportunity and risk: while competition among origins may stabilize prices, logistical or policy disruptions could quickly tighten supply.

Outlook Through 2030

Market forecasts point to sustained 4–6 % annual growth in U.S. cashew demand.

Trade data supports this projection: import volumes remain strong, consumption continues to rise, and price volatility has eased from 2022 highs.

Key factors to watch:

- Supply diversification may gradually rebalance the U.S. import mix, reducing dependence on Vietnam.

- Weather variability: HSAT CropGPT data shows ongoing rainfall deficits across West Africa and irregular precipitation across Southeast Asia — conditions that could influence 2026 yield potential.

- Price range: Kernel values expected between USD 5,500–6,000 / ton, depending on freight and currency trends.

Why It Matters

For stakeholders, the message is clear:

- The U.S. market remains structurally bullish, but supply chains are now shaped as much by policy and weather intelligence as by production cycles.

- Monitoring production, weather, and trade policy in real time is essential to stay ahead of shifting margins.

Stay Ahead of Market Shifts

At Rotterdam Commodity Trading, we combine official trade data with real-time production and weather intelligence from HSAT’s CropGPT platform, providing a comprehensive view of global cashew supply — from orchard to import terminal.

Subscribe to our Weekly Cashew Report for data-driven insights on production, weather, and trade developments across all major origins.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.