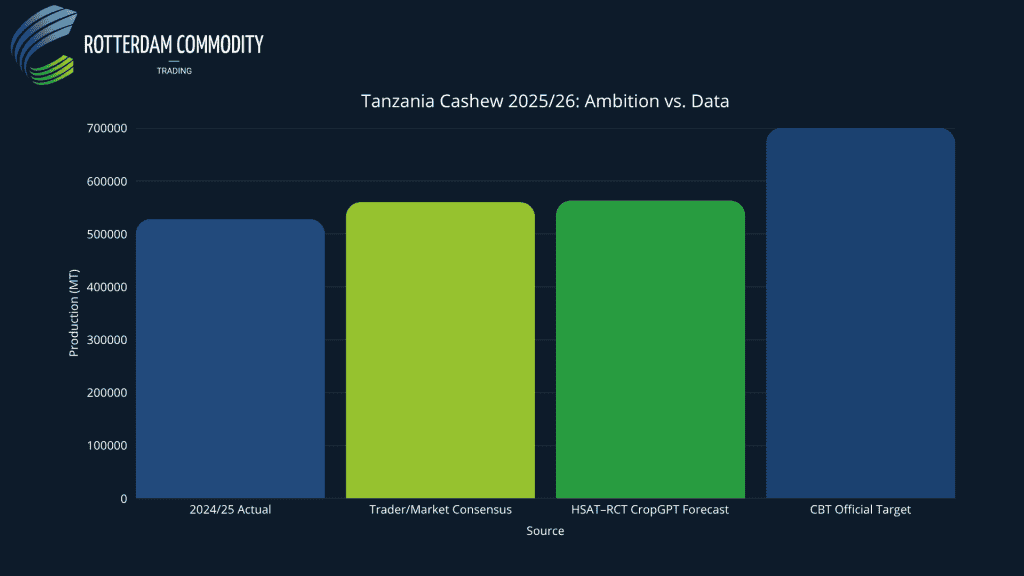

The Cashewnut Board of Tanzania (CBT) has reaffirmed its ambitious target of 700,000 metric tons for the 2025/26 cashew season — nearly one-third higher than last year’s record harvest of 528,260 tons.

While official statements emphasize favorable weather and expanded planting, independent forecasts and trade sources remain far more cautious, pointing to an outcome closer to 560,000 tons.

Government Optimism: Record Inputs and Expansion Plans

According to the CBT and local media, the 700,000-ton target rests on a mix of policy support, field programs, and ideal growing conditions.

The Tanzanian government has stepped up its support initiatives for farmers, including training, field supervision, and coordination through the Building a Better Tomorrow (BBT) program. (The Citizen, Sept 2025).

Additionally, 500 agricultural graduates from the BBT scheme have been deployed to assist cashew farmers across major producing regions (Mtwara, Lindi, Ruvuma, Tanga, Pwani).

CBT Executive Director Francis Alfred said preparations are “on track” across all major growing zones, and that the target “will be achieved provided there are no major climatic disruptions” (Ecofin Agency, Sept 2025).

The Board has also invested in new storage infrastructure — two 10,000-ton government warehouses in Mtwara and Lindi — and has procured 8.75 million jute bags to handle the expected crop volume (African Cashew Alliance (ACA) report, Oct 2025).

Independent Data Tells a Different Story

Trade observers and independent data sources show a more moderate outlook.

The African Cashew Alliance notes that while the 700,000-ton figure aligns with government aspirations, traders and exporters expect 550,000–570,000 MT based on field reports from southern Tanzania (ACA Weekly Market Brief, Oct 2025).

These figures match HSAT’s AI-driven CropGPT model, which currently forecasts ~563,000 tons for the 2025/26 season — up slightly (+6%) from last year, but far below the official target.

“The 700,000-ton goal reflects policy ambition rather than field reality.

Our satellite and weather-based models indicate a smaller, steady increase,”

— HSAT CropGPT, Weekly Cashew Report – Week 42 (2025). (Read full report here)

Historical data also underscores the risk of overoptimism:

Tanzania set a 400,000-ton goal for 2023/24 but harvested only 305,000 tons;

in 2024/25, output surged to 528,260 tons, marking an exceptional rebound.

A further +33% jump this year would be unprecedented given the maturity cycle of new trees and uneven adoption of input programs .

Weather & Bloom: Strong but Slightly Delayed

Satellite and field data confirm that Tanzania’s 2025 season started later than usual, prompting CBT to delay the auction opening to October 31 due to “late flowering” (CBT Auction Notice, Oct 2025).

Weather in major cashew belts was mostly near average:

Tanga and Muheza recorded 15–23 mm of rainfall (≈10% below long-term averages), while Mtwara and Masasi ran slightly wetter — insignificant as long-term means were just 2–3 mm.

Overall, conditions were rated “favorable and seasonally normal,” per the HSAT–RCT Weekly Cashew Report: Week 42.

Importantly, no widespread pest or fungal outbreaks have been reported, suggesting that early-season spraying and dry harvesting weather are sustaining yield potential.

Thus, the delay is more logistical than biological — crops are healthy, but peak picking will fall slightly later in the calendar.

Bridging the Forecast Gap: 700k vs. 563k

The wide divergence between CBT’s 700,000 MT goal and HSAT’s ~563,000 MT projection stems from several structural and methodological differences:

- Policy vs. Probability: CBT’s figure is a target, not a data-driven forecast — it assumes ideal conditions and full resource uptake.

HSAT’s model incorporates real-time satellite data, field verification, and weather anomalies. - Tree Age Factor: Thousands of new cashew trees planted since 2021 are still maturing and yield below potential.

Government projections likely include acreage not yet fully productive. - Input Efficiency: Subsidized inputs don’t always reach or are unevenly applied across all farmers — limiting uniform yield gains.

CBT itself acknowledged improvements are still needed in last-mile distribution (The Citizen). - Historical Volatility: Past swings (305k → 528k → 700k goal) show how targets often exceed realized outputs.

CropGPT’s historical model adjusts for such oscillations.

Market Implications

If Tanzania’s 2025/26 harvest reaches around 560,000 tons, it would be broadly in line with current market expectations and represent a steady year-on-year increase from 528,000 tons in 2024/25.

By contrast, a full 700,000-ton harvest would have significantly expanded global raw cashew nut (RCN) supply and likely eased international prices.

With output expected closer to 560k, price effects are expected to remain neutral — providing stability rather than the downward pressure a record oversupply would have created.

Why It Matters

Tanzania’s case highlights the difference between policy ambition and satellite-measured reality.

While the CBT’s target underlines confidence and government commitment, independent models such as HSAT’s CropGPT — trained on billions of datapoints across Africa — provide a more grounded assessment of yield potential.

For traders and processors, the truth likely lies in between: a strong, above-average harvest but below the 700k political target.

Subscribe to our Weekly Cashew Report

Get data-driven insights each week — powered by HSAT’s CropGPT, combining satellite imagery, ground intelligence, and AI forecasting.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.