Industry sources indicate India imported more than 118,000 tons of RCN in the first three weeks of September, with Guinea-Bissau leading arrivals. Kernel prices in key domestic hubs were reported broadly stable even as the rupee weakened (~₹88.7/USD late September). Ahead of Diwali, some market reports expect domestic demand to strengthen.

At the same time, other trader feedback paints a different near-term picture: slow offtake, tight cash flow, and delayed clearance of landed goods; some sellers reportedly diverting volumes to Vietnam where movement is firmer. Additional signals shared to us suggest ~100,000 mt in August, >900,000 tons RCN imported in Jan–Aug, and a full-year run rate ~1.15–1.20 million tons. These are market observations, not yet publicly verified statistics.

What our data says (Week 40, CropGPT)

- Weather & growing conditions: India’s main cashew belts were cooler than normal in September (Konkan ~−2.2 °C vs LTA). Rainfall was above norms in Ganjam (Odisha, +83%) and below norms in Visakhapatnam (AP, −18%); broader belts trended −1.5 to −2.0 °C vs LTA.

- Production outlook: 2025 harvest ~800,000 tons. 2026 forecast: 786,000 tons, a slight adjustment as rainfall normalizes. This indicates stability on the supply side rather than a structural surge.

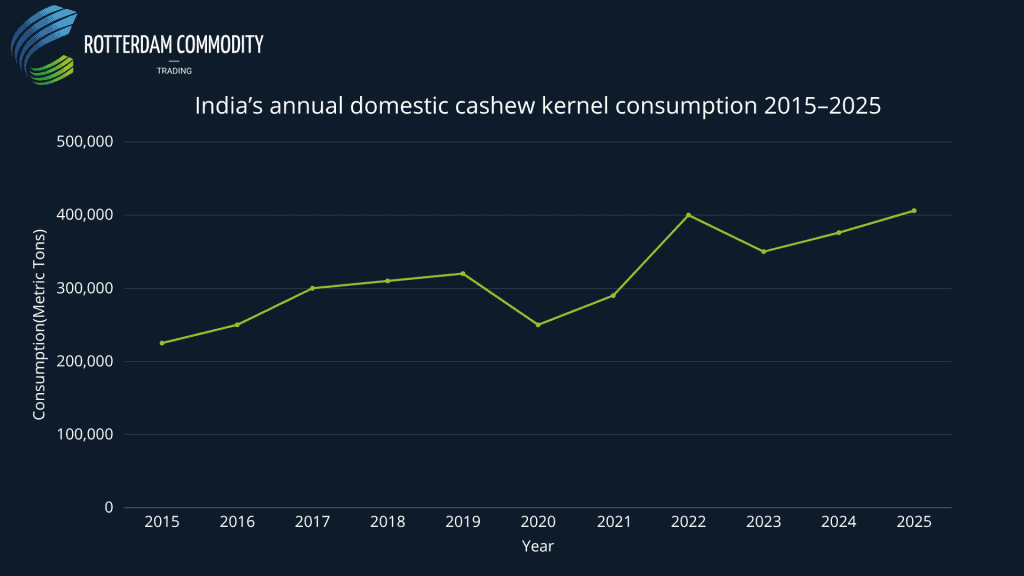

Ten years of consumption growth: Despite these short-term mixed signals, the long-term trend is clear — India’s domestic cashew consumption has more than doubled over the past decade. After dipping in 2020 during COVID-19, demand surged to record highs in 2022, eased slightly in 2023, and is projected to climb back above 400,000 tons in 2025.

India’s annual domestic cashew kernel consumption, 2015–2025. Data sourced from CEPCI, INC, and industry reports.

How this squares with the signals:

- RCN buying: Strong September/late-Q3 imports are consistent with processors front-loading supply.

- Demand tone: The festive uplift narrative (pre-Diwali) coexists with reports of tight liquidity and slow consumer pull-through. Our read: short-term demand could firm, but the medium-term balance remains steady, given our flat production profile into 2026.

What to watch next (practical checks)

- Warehouse clearance pace after Diwali (does inventory move faster week-on-week?).

- Kernel offer behavior (do W240/W320 quotes rise, or do discounts reappear?).

- Import cadence into Oct/Nov (does the Sept intensity sustain, or fade?).

- INR path (continued weakness could re-pressure processor margins).

These indicators will quickly confirm whether the festive bump becomes a sustained improvement, or whether liquidity constraints keep domestic demand subdued.

Why this matters

For traders and buyers, India’s short-term import spikes don’t automatically equal structural demand strength. With production steady (~800k → 786k), the market’s near-term direction hinges on how much of the festive uplift translates into real kernel offtake and how quickly landed RCN converts to sales.

At Rotterdam Commodity Trading, together with HSAT’s CropGPT, we track these shifts weekly—combining satellite-derived crop signals, weather anomalies, and on-the-ground intelligence to distinguish durable trends from one-off spikes.

Stay ahead of India’s cashew outlook — subscribe to our Weekly Cashew Report for data-backed forecasts and timely market signals.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.