Vietnam is exporting near-record volumes of cashew kernels in 2025 — even as shipments to the U.S. have fallen sharply due to new tariffs. This paradox underscores deeper shifts in global demand, raw nut sourcing, and trade alignment that are reshaping the industry in real time.

2025 Exports Already Near Last Year’s Total

Vietnam exported 76,192 metric tons of cashew kernels in September 2025, according to VINACAS — a 27% increase month-on-month and a 31% rise in value year-on-year. That single month brought year-to-date exports to 574,204 metric tons, equivalent to about 79% of 2024’s full-year record of approximately 730,000 metric tons.

With three months still remaining in the year, Vietnam is firmly on track to match or even surpass its all-time export record, underscoring the strength of its processing sector — even as one of its largest historical buyers, the United States, has sharply reduced purchases.

China Offsets U.S. Decline

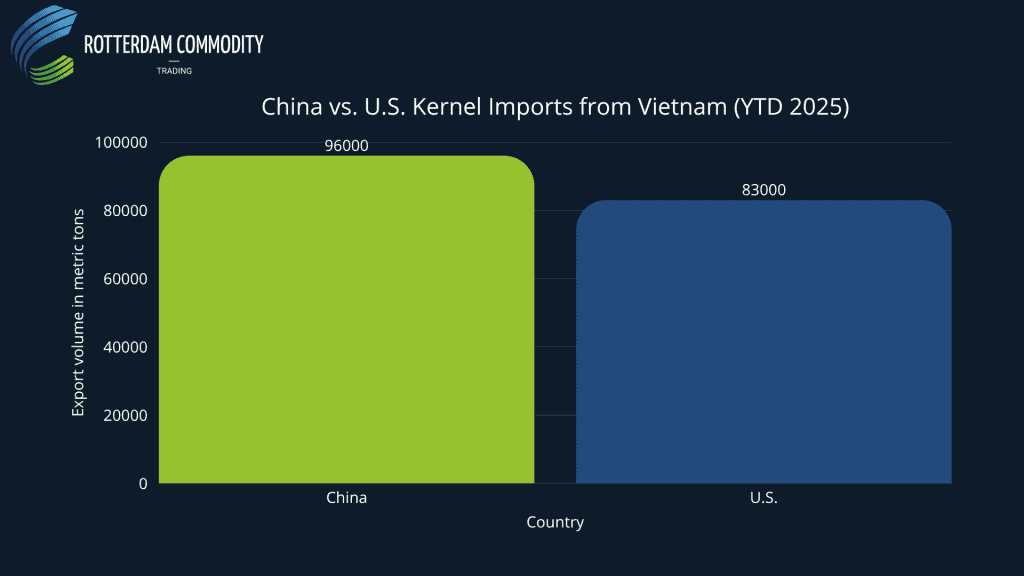

Vietnam’s largest growth market in 2025 is not the U.S., but China. Year-to-date exports to the U.S. have dropped 34.5% by volume, following the implementation of a 20% U.S. import tariff on Vietnamese kernels in July 2025.

Meanwhile, China’s imports surged by 132.8% year-on-year in September alone and are up 31.1% year-to-date. For the first time, China has overtaken the U.S. as Vietnam’s largest single export market for kernels.

What’s driving this Chinese surge?

- Pre-festival stockpiling, especially ahead of the Mid-Autumn Festival

- Booming demand for healthy snacks driven by online grocery and e-commerce

- Cashew’s role in China’s national nutrition guidelines

- Better alignment of Vietnamese exports with China’s phytosanitary and traceability standards

Combined, these factors have helped Vietnam absorb the loss in U.S. demand — at least for now.

Raw Nut Sourcing: Cambodia Takes the Lead

Vietnam’s record exports have been underpinned by extraordinary raw cashew nut (RCN) import volumes, particularly from Cambodia and Ivory Coast.

As of September 2025:

- Cambodia has supplied 981,651 mt of RCN year-to-date

- Ivory Coast follows with 555,976 mt

While Ivory Coast remains a strategic partner, Cambodia has become Vietnam’s largest RCN supplier by far — supplying nearly twice as much volume. This reflects both expanding cashew acreage in Cambodia and strong logistical ties between the two countries.

Outlook for 2026: What the Forecasts Say

HSAT’s CropGPT platform, which models national yields using satellite imagery, climate data, and ground reports, points to a mixed outlook for global production in the 2025/26 season:

| Country | Forecasted Yield | Trend & Commentary |

|---|---|---|

| 🇻🇳 Vietnam | ~1,455 kg/ha | Strong recovery due to favorable rains |

| 🇰🇭 Cambodia | Under review | Large area planted, uncertain yield |

| 🇨🇮 Ivory Coast | –10% to –15% | Dry conditions expected to reduce crop |

- Vietnam’s expected yield rebound could bring domestic production close to 450,000 mt — a much-needed shift after prior shortfalls.

- Cambodia’s output remains weather-dependent, but the area planted (over 580,000 ha) suggests continued high volumes.

- In Ivory Coast, widespread dryness and stress on trees may lead to a significant drop in 2026 output, tightening global RCN supply.

Why This Matters

Vietnam’s ability to grow exports despite losing ground in the U.S. illustrates the resilience and adaptability of its processing industry. But this growth depends heavily on:

- Sustained Chinese buying

- Ample raw nut supply from Cambodia and West Africa

- Stability in global pricing and freight costs

Any shock — be it climatic, regulatory, or geopolitical — could quickly shift this balance.

Stay Ahead of Market Shifts

This analysis combines official Vietnamese trade data, market intelligence, and HSAT’s AI-powered production forecasts.

Subscribe to the Weekly Cashew Report for early insight into yields, demand, and global trade flows.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.

We use cookies to ensure you get the best experience on our website. For more information, please read our Privacy Policy.